[Use Case] Expanding Digital Asset Experiences in Financial Services - iM Bank Case Study

![[Use Case] Expanding Digital Asset Experiences in Financial Services - iM Bank Case Study](/content/images/size/w1200/2026/01/Thumbnail_iMBank_en.png)

A Customer Experience Transformation Case of iM Bank

As digital transformation becomes a central challenge across the financial industry this year, banks are increasingly confronted with a critical question not whether to adopt new technology, but how to deliver new digital value without disrupting existing customer experiences. While blockchain and digital assets have long been recognized for their potential, their adoption in financial services has required a cautious approach due to technical complexity, regulatory considerations, and varying levels of user familiarity.

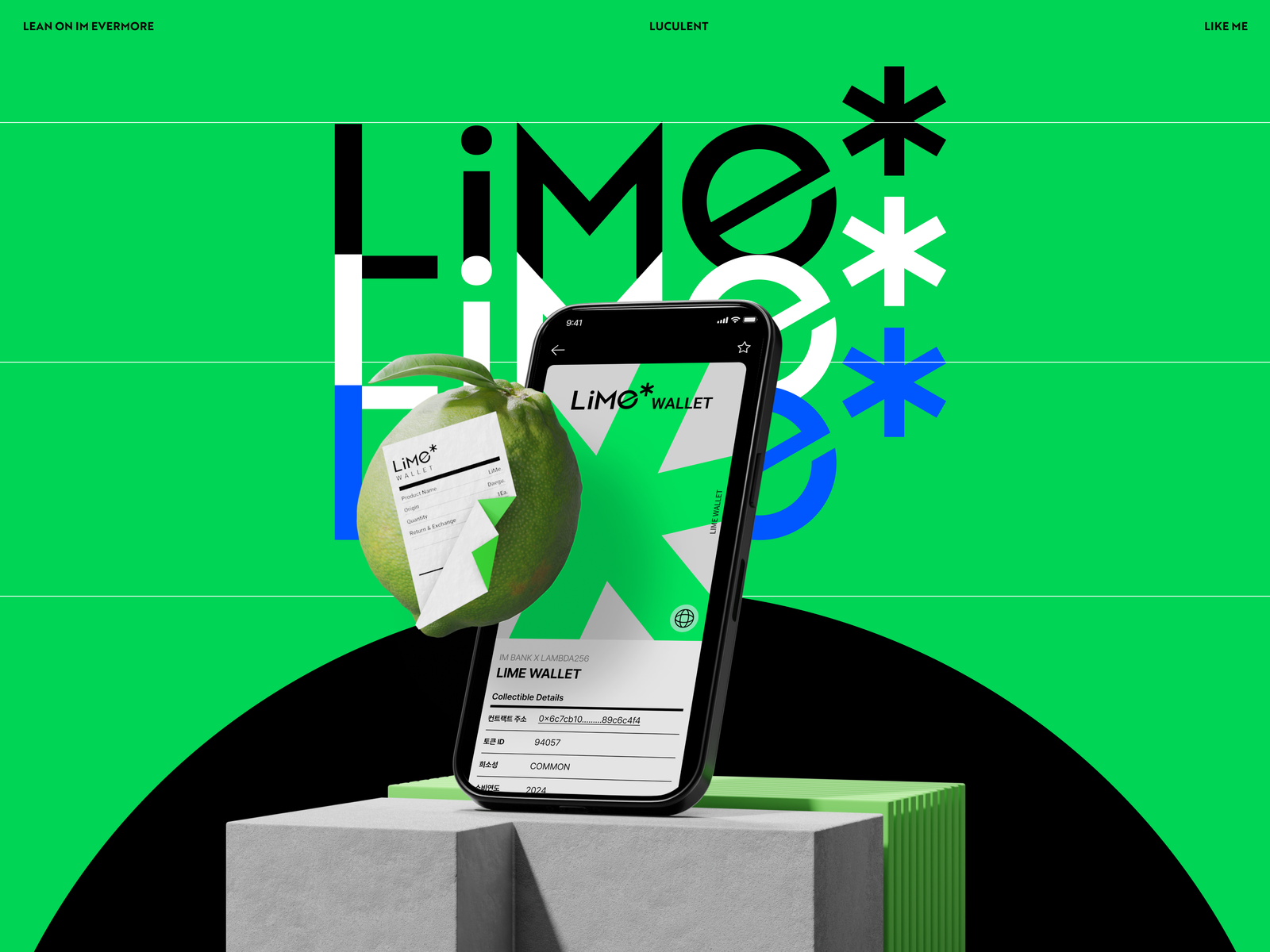

iM Bank, a South Korean bank pursuing a “new hybrid bank” strategy, partnered with Lambda256 to address this challenge by positioning blockchain not as a separate service category but as an extension of its core financial services. Combining the strengths of a regional bank with deep local customer relationships and the digital convenience of nationwide commercial banks, iM Bank and Lambda256 focused on enhancing mobile-first services, intuitive UI and UX, and customer-centric digital asset experiences. Through this collaboration, the project was designed to expand customer value from a financial service perspective, with technology serving as an enabler rather than the focal point.

A Financial Service First Approach to Digital Assets

Not surprisingly, the core focus of this initiative was not blockchain technology, but the seamless expansion of the customer journey to digital assets. By enabling digital asset related features directly within the existing mobile banking environment, iM Bank minimized friction and avoided forcing customers to adopt new applications or complex onboarding processes.

Through collaboration with STUDIO256, iM Bank integrated digital asset functionality seamlessly into its mobile app. The service was designed so that users did not need to consciously manage wallets or private keys, allowing them to experience digital assets naturally within familiar banking workflows. This approach significantly lowered the entry barrier for general banking app users who may be unfamiliar with blockchain technology, while maintaining a consistent and intuitive user experience.

This user experience driven approach also received external recognition. iM Bank’s digital asset based service was awarded at the iF Design Award, one of the world’s most prestigious design awards, officially acknowledging the excellence and completeness of its user experience design within a financial services context.

Digital Asset Architecture Designed Within Financial Trust Frameworks

For financial institutions, introducing digital assets goes far beyond adding new features. Security, stability, operational control, and alignment with internal policies are essential requirements that must meet the rigorous standards of existing financial systems.

In the iM Bank project, the focus was on ensuring enterprise grade reliability and operational stability without exposing blockchain technology at the surface level. Digital assets were designed not as short term marketing tools, but as long term components that enhance financial service experiences and strengthen customer relationships over time. This reflected a strategic emphasis on sustainability rather than short lived visibility.

The iM Bank case demonstrates that digital assets do not need to be confined to new financial products or investment offerings. Instead, they can function as practical tools to increase customer engagement, expand digital experiences, and create new forms of interaction within the established framework of financial services. Rather than highlighting the adoption of blockchain itself, this project illustrates a clear direction for how financial services can evolve.

Lambda256 will continue to support financial institutions in integrating blockchain and digital assets into their services in ways that align with trust, stability, and real world usability, connecting technology with meaningful customer experiences.

About Lambda256

Lambda256, the blockchain affiliate of Dunamu, is a leading Web3 technology company driving innovation across infrastructure, data, and digital finance. Since its spin-off in 2019, Lambda256 has built platforms that connect enterprises and developers to blockchain, including Nodit for infrastructure, Clair for data intelligence, and Scope for stablecoin issuance. With proven experience supporting financial institutions, global partners, and large-scale Web3 applications, Lambda256 continues to shape the future of digital transformation with enterprise-grade blockchain solutions.

![[Use Case] 전통 금융 서비스에 디지털자산 경험을 더하다 - iM 뱅크의 고객 경험 확장 사례](/content/images/size/w600/2026/01/Thumbnail_iMBank_ko-1.png)

![[Use Case] Merkle Trade: 대규모 실시간 거래를 지원하는 블록체인 노드·데이터 인프라 사례](/content/images/size/w600/2026/01/Thumbnail_Merkle_en-2.png)